The company may pay dividends in the form of. Dividends

The issue is usually raised at the annual general meeting of participants in business companies (JSC, LLC). Information is needed to solve it about the amount of net profit received by the company and the size of its net assets. The calculation of these indicators, as well as the subsequent payment of dividends, falls on the shoulders of the accountant. Therefore, below we will answer the most common “dividend” questions from accountants, including questions about how to determine net profit when applying the simplified tax system and when to pay participants for accrued dividends.

When can dividends be paid?

Only companies with good financial performance can pay dividends.

After all, firstly, dividends are calculated based on the earnings received at the end of the year or on the basis of retained earnings from previous years (Clause 1, Article 28 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14 -FZ); clause 2, article 42 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” (hereinafter referred to as Law N 208-FZ); Letter of the Ministry of Finance of Russia dated 04/06/2010 N 03-03-06/1 /235; Letter of the Federal Tax Service of Russia for Moscow dated June 23, 2009 N 16-15/063489).

And secondly, on the day the decision is made on the distribution of net profit, as well as on the date of payment of dividends, the company must meet a number of requirements, in particular (Article 29 of Law No. 14-FZ; Article 43 of Law No. 208-FZ):

Its authorized capital must be fully paid;

The size of its net assets should not be less than its authorized capital.

In addition, the payment of dividends should not lead to the organization showing signs of bankruptcy (Clause 2, Article 29 of Law No. 14-FZ; Clause 4, Article 43 of Law No. 208-FZ).

Let us recall that the size of net assets is determined based on the balance sheet data. And if you did not buy shares from shareholders, then you can calculate net assets using the formula(Order of the Ministry of Finance of Russia N 10n, FCSM of Russia N 03-6/pz dated January 29, 2003; Letter of the Ministry of Finance of Russia dated December 7, 2009 N 03-03-06/1/791):

Net assets = Assets (line 300) + Deferred income (line 640) - Liabilities (line 590 + line 690)

Dividend calculation simplified

If you keep full accounting records using the simplified taxation system, then you will not have any problems with calculating dividends. But if not (Clause 3 of Article 4 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”), then for the purpose of determining net profit you can proceed as follows:

(or) develop your own methodology for calculating net profit. However, such techniques usually do not provide reliable information about the financial position of the company in comparison with accounting data. Therefore, the tax authorities may regard the amounts paid on their basis not as dividends, but as gratuitously transferred money or wages (if the participant is also an employee of the organization).

Note

In this case, tax authorities will calculate taxes at general rates:

- for a participating organization - income tax based on a rate of 20% instead of 9% (for Russian companies) or 15% (for foreign companies);

- to an individual participant - personal income tax at a rate of 13% instead of 9% if he is a resident of the Russian Federation, and at a rate of 30% instead of 15% if he is a non-resident of the Russian Federation (Clause 1, 3 of Article 224, paragraph 1, paragraphs 2, 3 Clause 3 of Article 284 of the Tax Code of the Russian Federation).

In addition, your organization may be fined for incomplete withholding and transfer of personal income tax and income tax (Article 123 of the Tax Code of the Russian Federation).

At the same time, some organizations were able to prove in court the legality of calculating net profit using their own methods (Resolutions of the Federal Antimonopoly Service of Moscow dated July 20, 2009 N KA-A41/6492-09; the Twelfth Arbitration Court of Appeal dated July 7, 2009 in case N A57-1360/09) ;

(or) restore accounting records for all periods for which dividends are planned to be paid. By the way, this is the method that the regulatory authorities insist on, and therefore it is the safest (Letters of the Ministry of Finance of Russia dated 08/20/2010 N 03-11-06/2/134, dated 01/29/2008 N 07-05-06/18);

(or) draw up an inventory balance and fill out financial statements on its basis. This option is convenient, for example, when accounting has not been maintained for a long time and it is unrealistic to restore it. With this method, at the end of the reporting period the following balances are entered into the balance sheet:

For cash, current accounts, fixed assets and intangible assets - according to accounting data;

For known items of capital (authorized capital, reserve fund, etc.);

For other balance sheet items - based on inventory results (according to target accounting data for the main areas, for example, target accounting of goods, settlements with suppliers, settlements with customers).

The positive difference between the assets and liabilities of such a balance sheet will be the retained earnings of the reporting period.

Dividend payment terms

You must pay dividends within 60 days from the date the general meeting of participants makes a decision on this, unless a shorter period is specified in the charter or decision (Clause 3 of Article 28 of Law No. 14-FZ; Clause 4 of Article 42 of Law No. 208-FZ).

Attention! Since 2011, dividends to participants in LLCs and JSCs must be paid within a maximum of 60 days from the date of the decision to pay them.

Sometimes the general meeting approves a schedule for the gradual payment of dividends. Dividends can be paid in stages if the following conditions are met:

All payments are made within the period specified by the charter (maximum 60 days);

Dividends on shares of one category (type) are paid simultaneously to all owners of shares of this category (type) (Clause 4 of Article 42 of Law No. 208-FZ).

If, through your own fault, you violate the deadlines for paying dividends, the participant may demand payment of interest for the use of other people’s funds for the entire period of delay. However, if the participant himself is to blame for the delay (did not provide bank details, did not show up to receive money at the cash desk), then you do not have to pay interest (Clause 3 of Article 405, paragraphs 1, 3 of Article 406 of the Civil Code of the Russian Federation). Of course, in this situation, you can deposit the amount due to the participant into the notary’s deposit account (Subclause 4, clause 1, Article 327 of the Civil Code of the Russian Federation), but this is your right, not an obligation.

Attention! If dividend payment deadlines are violated, participants have the right to demand that your company pay interest for the use of other people's funds (Article 395 of the Civil Code of the Russian Federation).

You will not have to pay interest in other cases when the delay is not your fault. For example, if the company did not pay dividends due to the fact that on the day of payment its net assets became less than the amount of the authorized capital (Clause 2 of Article 29 of Law No. 14-FZ; Clause 4 of Article 43 of Law No. 208-FZ).

Payment of dividends to third parties

You can pay dividends to the participant himself, or you can, on his instructions, transfer money to another organization or individual, including in payment for goods (work, services) purchased by the participant (Articles 309, 312 of the Civil Code of the Russian Federation).

Note

In this situation, you remain the tax agent of the participant, therefore you withhold “dividend” taxes from such payments in the usual manner, that is, when they are transferred on behalf of the participant to third parties (Clause 1, Article 43, paragraph 1, Article 226, paragraph 2 Article 275 of the Tax Code of the Russian Federation).

And if the heir of a participant comes to you for dividends, then you need to look at his certificate of inheritance. If it states that he inherits the right to receive dividends or all the property of the testator, then you are obliged to pay him dividends accrued in favor of the deceased participant (Clause 1, 2 of Article 382, Article 387, paragraph 1 of Article 1110, Art. 1112, paragraph 1 of Article 1162 of the Civil Code of the Russian Federation). Be sure to keep a copy of this certificate for yourself.

Unclaimed dividends

Dividends become unclaimed if the company for some reason does not voluntarily pay them, and the participant does not apply for them within the prescribed period.

Since 2011, a participant has the right to apply for payment of dividends within the following periods.

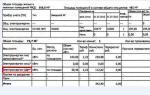

|

Dividend period |

Deadline for presentation |

Duration, within |

|

(or) in 2011 and later |

(or) not installed |

Within 3 years from the date |

|

More than 3 years, but not |

During the period, |

|

|

More than 5 years |

Within 5 years from the date |

|

|

From 12/31/2007 to 12/30/2010, |

From 01/01/2011 to |

After these deadlines, dividends are considered unclaimed and you have the right to refuse to pay them to the participant.

You do not take into account the amount of unclaimed dividends for tax purposes (Subclause 3.4, Clause 1, Article 251 of the Tax Code of the Russian Federation; Clause 4, Article 28 of Law No. 14-FZ; Clause 5, Article 42 of Law No. 208-FZ).

If in 2007 - 2010 you, as required by the Ministry of Finance (Letter of the Ministry of Finance of Russia dated February 14, 2006 N 03-03-04/1/110), included the amounts of unclaimed dividends in non-operating income, now you can submit updated declarations for the periods in which you included them in income (starting from 01.01.2007), with an application for offset or refund of overpaid tax (Part 2 of Article 4 of Federal Law of December 28, 2010 N 409-FZ; clause 7 of Article 78 of the Tax Code of the Russian Federation).

Tell your boss

The amounts of unclaimed dividends must be restored as part of retained earnings, that is, the company's participants will be able to decide to re-distribute this money among themselves.

This year, remember two innovations: first, dividends must now be paid no more than 60 days from the date of the decision to pay them, even if the charter provides for a longer period, and second, a tax benefit has appeared on restored dividends.

Dividend payment dates in 2018have not changed compared to the previous year. However, they have their own characteristics depending on the form of the legal entity. Let's remind them.

Concept of distributable income

Distribution of dividends is the prerogative of commercial organizations whose purpose of existence is to make a profit. A dividend is a profit received for a certain period intended for distribution among the participants of this organization. Profit can be distributed in full or in part.

In the Russian Federation, commercial firms are usually created in one of 2 forms:

- in the form of a joint-stock company (JSC), guided by the Federal Law “On Joint-Stock Companies” dated December 26, 1995 No. 208-FZ;

- in the form of an LLC, applying the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ.

In the 1st of these laws, the concept of dividends is used in relation to the payment of income (Chapter V), and in the 2nd law there is no such concept, although the issue of profit distribution is discussed in it (Articles 28, 29 of Law No. 14-FZ) .

Both of these concepts (dividend and profit distribution) are united by Art. 43 of the Tax Code of the Russian Federation, which classifies as dividends any income received by a participant or shareholder as a result of the distribution of net profit in proportion to his share of participation.

Restrictions on dividend payments

In order to distribute dividends, the mere fact of profit is not enough. Both of the above laws contain lists of very similar restrictions (Article 43 of Law No. 208-FZ and Article 29 of Law No. 14-FZ), which apply not only to the date of the decision on payment, but also to the date of payment (if the situation has changed by the time of payment ).

Limitations common to both organizational forms:

- The management company must be paid in full.

- Net assets must exceed the sum of the authorized capital and reserve fund even after payment of dividends. For a joint-stock company, the amount of the excess of the value of preferred shares over their par value is also added to the amount of the authorized capital and reserve fund.

- Signs of bankruptcy must not occur or arise as a consequence of the payment of dividends.

A special restriction for an LLC: a decision on payment is not made until the actual value of the share (or part thereof) has been paid to the retiring participant.

According to the AO, a decision cannot arise:

- until the completion of the repurchase from shareholders of shares in respect of which there is a right to demand their repurchase (Clause 1, Article 75 of Law No. 208-FZ);

- without observing the correct sequence of making a decision on the payment of dividends: first in relation to those preferred shares that have special advantages, then on other preferred shares and only then on ordinary shares.

Both laws contain a clause that under an existing payment decision that has not been implemented due to restrictions that arose at the time of payment, the issuance of dividends is mandatory after the disappearance of these restrictions.

Frequency and methods of payment

In both forms (JSC and LLC), it is allowed to make a decision on the payment of dividends with a frequency of 1 time:

- per quarter;

- half year;

Quarterly and semi-annual distributions will be considered interim. The payment of such dividends is assessed accordingly. If at the end of the tax period (year) it turns out that dividends on it can be distributed in a smaller amount than has already been done, this will entail the attribution of excess payments to ordinary income and the need to additionally charge insurance contributions to funds that do not pay dividends. accrue.

A legal entity is not necessarily required to make a decision on the payment of income. There may also be a decision on non-distribution of profits, usually made at the end of the year.

Law No. 208-FZ directly lists the methods of paying dividends (in money or property), while Law No. 14-FZ does not indicate either the methods of payment or any restrictions on them. Thus, it is possible to pay dividends regardless of the form of the legal entity:

- cash from the cash register.

- by non-cash transfer to the participant’s bank account;

- property.

From the amount of accrued income, personal income tax (for an individual) or income tax (for a legal entity) must be withheld. For the calculation, a rate of 13% is used for residents (clause 1 of Article 224 and subclause 2 of clause 3 of Article 284 of the Tax Code of the Russian Federation) and 15% for non-residents (clause 3 of Article 224 and subclause 3 of clause 3 of Article 284 Tax Code of the Russian Federation). The question of paying tax when paying dividends to a legal entity arises regardless of what taxation regime is applied by the organization that decided to issue them.

For taxation of dividends from individuals, see the material.

The specified rates are used in relation to dividends paid in 2018, regardless of the year for which they are paid and what rate was in effect in the year for which they were accrued. For an individual, this income is taken into account separately from other income taxed at the same rate. In the case of payment of dividends to a legal entity that owns more than 50% of the capital, the rate may be 0% (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

The situation of issuing dividends with property is regarded as a sale (letter of the Ministry of Finance of Russia dated December 17, 2009 No. 03-11-09/405), entailing the payment of VAT and income tax from the transferring party. At the same time, the obligation to pay tax for the recipient of dividends is not relieved. Taxes are calculated based on the market value of the property. If there is no interdependence, this value is equal to the contractual value of the transfer. The issue of establishing the market value will be significantly complicated in the case of interdependence of persons (participation share of more than 20%) and the presence of constituent entities of the Russian Federation among the participants.

How is the payment decision made?

This decision is made by the general meeting:

- shareholders in the joint-stock company (clause 3 of article 42 of law No. 208-FZ).

- participants in an LLC (Clause 1, Article 28 of Law No. 14-FZ).

The financial statements for the relevant period must be ready for the meeting, their data must be analyzed to ensure compliance with the restrictions established for making a decision on payment, and the amount of profit that can be used to pay dividends must be determined.

The result of the meeting is a protocol, which, when executed by the JSC, must contain (clause 2 of Article 63 of Law No. 208-FZ) the following:

- time and place of the meeting;

- the total number of votes and votes of meeting participants;

- information on the election of the chairman and secretary;

- agenda;

- the results of consideration of each of the issues;

- final decision.

The listed data will not be superfluous in the protocol drawn up by the LLC.

With regard to dividends, the meeting of the joint-stock company must decide on the following points:

- for what period they are paid;

- total payment amount and size for each type of shares;

- the date on which the composition of shareholders will be determined;

- form and term of payment.

For LLCs, the following are excluded from this list:

- the amount of dividends for each type of shares;

- the date on which the composition of shareholders will be determined.

The distribution of the total amount between specific persons is carried out:

- in a JSC - according to the algorithm laid down in the charter, depending on the types and number of shares;

- in an LLC - in proportion to shares, unless the charter contains a different order.

The general meeting is not held by the sole founder. It is enough for him to make a decision on the payment of dividends, formalizing it as any of his decisions, indicating the date of preparation and the essence of the issue on which the decision is being made.

Terms of payment of dividends in JSC

The period for issuing dividends to the joint-stock company is counted from the date on which the composition of shareholders is determined and is no more than (clause 6 of article 42 of law No. 208-FZ):

- 10 working days for payment to nominee holders and trustees;

- 25 working days for payment to other shareholders.

Terms of payment of dividends in LLC

For an LLC, the period for issuing dividends is limited to 60 days from the date of the decision (Clause 3, Article 28 of Law No. 14-FZ). A specific period within these 60 days may be established by the charter or a meeting of participants. If such a period is not recorded in the LLC documents, it is equivalent to 60 days.

Consequences of failure to pay dividends on time

Both laws provide the same procedure for situations of non-payment of dividends on time. They can be claimed by the participant within 3 years (or 5 years if this is stated in the charter) from the date:

- making a decision on payment to the joint-stock company (clause 9 of article 42 of law No. 208-FZ).

- completion of the 60-day period in the LLC (Clause 4, Article 28 of Law No. 14-FZ).

If dividends are unclaimed at the end of these periods, they are returned to profit and claims for them are no longer accepted.

The legislation does not provide for any sanctions for exceeding the deadline for paying dividends. The consequences may be that the participants go to court demanding the payment of not only dividends, but also interest for the delay in their transfer. If it is proven that the JSC that accrued the dividends opposes their payment, then a fine is possible under Art. 15.20 of the Code of Administrative Offenses of the Russian Federation in the amount of:

- from 20,000 to 30,000 rub. for officials;

- from 500,000 to 700,000 rubles. for legal entities.

A limited liability company is a form of doing business in which the procedure for calculating and paying dividends largely depends on the decisions made when creating the enterprise, taking into account changes made during the work process. Let's look at the procedure for calculating dividends in an LLC payable in 2018, with examples.

Documents for counting

Dividends are payment to a company participant of a portion of the net profit. Profit is calculated according to accounting rules. The period for which profit is taken into account is determined by the charter of the LLC.

In 2018, payments are due for the results of 2017, as well as for the results of quarters and half-years of 2018. The period for which dividends can be accrued is determined by the constituent documents of the company and legislative acts of the Russian Federation.

The main acts that determine the procedure for this payment are:

- 14-FZ “On LLC” dated 02/08/1998;

- Tax Code of the Russian Federation;

- charter of the company;

- minutes of the regular/extraordinary meeting of LLC participants.

Due to the fact that the main provisions of the Federal Law “On LLC” must be enshrined in the charter, it is enough for the founder or other person who calculates the amount of dividends to familiarize themselves with the constituent documents. You also need to know the provisions of the Tax Code of the Russian Federation regarding the procedure for accrual, taxation and payments to members of the company.

When signing the founding document of an LLC - the charter, participants are required to agree on the following provisions related to the accrual of funds:

When signing the founding document of an LLC - the charter, participants are required to agree on the following provisions related to the accrual of funds:

- profit sharing scheme (in proportion to contributions or based on other calculations);

- restrictions on the redistribution of profits (a list of circumstances under which dividends are not accrued, except for those already defined by law).

There are also a number of rules defined by law that the owners of the company do not have the right to change in the provisions of the charter:

- periods of redistribution of net profit;

- the procedure for making decisions on payments;

- circumstances under which participants have the right to redistribute profits.

In addition to acts defining general provisions on how to calculate dividends in an LLC, each payment must be preceded by a mandatory document - a decision of the general meeting.

The legislator and fiscal authorities make the following requirements for this act:

- the meeting must be held according to the rules defined by the Charter;

- all decisions on the redistribution of profits are made unanimously;

- the protocol must state the circumstances that confirm the existence of profits for redistribution, as well as indicate information about the absence of conditions under which distribution of profits is impossible;

- The participants decide by decision to determine the procedure, form and timing of settlements.

When making a decision, it is important to follow the meeting procedure. To a greater extent, this warning applies to those members of a limited liability company who plan to calculate profits based on the results of the quarters of the current year.

If the charter of the LLC stipulates that the regular meeting can be held only once a year, then when convening an extraordinary meeting, you need to coordinate your actions with the norms of the constituent act.

The minutes must be signed by the LLC participant presiding at the meeting.

If the company's documents do not reflect information that confirms the owners' right to payments from profits, as well as the procedure for making these payments, then no settlements can be made. Payment can only begin after the company’s documentation is in order.

Calculation procedure

Basic information required to determine payments:

- the amount of net profit based on the results of the reporting period for which the decision on its redistribution was made (data is in the financial statements of the enterprise);

- the size of shares in the authorized capital of each participant as a percentage;

- Availability of available funds to make payments.

If, when calculating, there is no reason to use any other system for determining the amount of redistributed profit due to each of the participants, then an example of how to calculate dividends in an LLC may look like this:

- The company has three owners with shares in the following percentage ratio: Participant 1 (P1) – 20%, Participant 2 (P2) – 45%; Participant 3 (U3) – 35%.

- At the end of 2015, the company’s net profit amounted to 362,514 rubles.

- The authorized capital is fully formed.

- The value of net assets is more than 5 million rubles.

- The calculated part of dividends for U1 is 362,514*20% = 72,502.80 rubles; for U2 – 362,514*45%= 163,131.30 rubles; for U3 – 362,514*35%=126879.9 rub.

The figures indicated in the fifth paragraph are estimates and cannot be issued for payment to participants in pure form. Before making a payment in favor of the owners, the executive body of the LLC (directorate) must perform the function of a tax agent:

If these actions are not completed, then as part of the next inspection by the fiscal authorities, the LLC will be fined a large amount, and will also have to fulfill the obligations of the tax agent to withhold taxes from dividends paid.

You can calculate dividends in an LLC under the simplified tax system according to the above scheme. The main difference in this case arises when calculating the amount of net profit to determine the total amount for distribution between the founders. This total amount is calculated according to the formula: “the net profit of the enterprise for the reporting period” minus “the simplified tax system paid for this period” is equal to “capital for redistribution between owners.”

The subsequent division of the total amount between the participants is carried out according to the above scheme.

Tax rules

The obligation of the executive body of an LLC as a tax agent depends on the status of the participants.

Possible statuses:

- citizen of the Russian Federation;

- foreigner;

- entity.

Government bodies cannot be the founders of an LLC, except in exceptional cases, which are regulated by separate federal laws.

Payments to citizens of the Russian Federation

For a citizen of the Russian Federation, accrued dividends are taxable income and personal income tax must be paid on them. The personal income tax rate for this type of accrual is 13%.

The calculation of deductions from dividends in an LLC in 2016 can be considered using an example: deductions from the payment due under U1 will be 72,502.80 * 13% = 9,425.36 rubles.

Accordingly, an amount of 72,502.80 – 9,425.36 = 63,077.44 rubles may be eligible for payment.

Personal income tax in the amount of 9,425.36 rubles. The LLC management must independently transfer it to the appropriate budget accounts.

Payments to foreigners

Dividends for foreigners are subject to personal income tax at an increased rate of 15%.

If, for example, U2 is a non-resident of the Russian Federation, then the personal income tax calculation is as follows: 163,131.30 rubles * 15% = 24,469.69 rubles. The amount to be paid is 138,661.60 rubles.

Dividends for legal entities

A participant in an LLC - a legal entity under the general taxation system - pays income tax (0-9%) on dividends received.

For legal entities using the simplified tax system (simplified taxation system), no tax obligations associated with receiving part of the distributed profit arise.

Dividends instead of salary to the director of an LLC: video

Dividends! We bet? Would you mind having a large block of shares in, for example, Gazprom or Sberbank and living without worrying about the dividends you receive for the rest of your life? Oh dreams, dreams. But you can still buy yourself a small piece of a large company (one or several). There is nothing complicated about this. And receive money annually into your account in the form of dividend payments.

For people who have never encountered this topic, many questions immediately arise:

- How much money do you need and where should you go to buy shares?

- How do you find out how much companies pay and which ones are the most profitable?

- How much profit can you expect and where do the dividends go?

This article collects some of the most popular questions about dividends.

What are dividends in simple words?

Dividends can be considered as a portion of the profits of the company in which the investor owns shares.

The amount of remuneration paid depends on financial results. If a profit has been made, then part of it is used for the development of the company, and part for the payment of dividends.

The total payout is divided by the number of shares outstanding. And a certain amount of profit per share is obtained.

For example:

- According to the charter, Gazprom is obliged to pay 10% of the profits received. In fact they pay more. In 2017, 45% of profits were allocated for dividend payments.

- Lukoil pays 25%. But we strive to increase this figure every year.

- The Moscow Exchange pays as much as 70% of profits for dividends.

- Sberbank pays 20-25% for dividends.

There are companies with very complex dividend policies. And it is very difficult for a novice investor to understand.

Norilsk Nickel - dividend policy Severstal - dividend payment policy

Severstal - dividend payment policy If we draw an analogy with ordinary life, then shareholders who own blocks of shares and regularly receive dividends can be compared to people who rent out real estate.

For example measures, you have an apartment that you rent out. You get 20,000 rubles a month for it.

From this amount, you pay part of it to pay for housing and communal services, and part of it to pay taxes. Perhaps you can send something for routine repairs. If you have a loan (mortgage), you will have to spend money on payments. Well, the rest is your net profit (dividends).

Now imagine that you own not one, but 30 apartments and you rent them all out.

Then the resulting net profit can be used a little differently. Buy another apartment (with your own money or on credit), that is, expand your business.

Eventually: the final balance of net income will decrease significantly. This part can be considered dividend income.

Where to buy shares to receive dividends?

Shares are traded on the stock market. In Russia, this is the MICEX (Moscow Interbank Currency Exchange).

You won't be able to buy shares directly. First you need to conclude an agreement with.

A broker is an intermediary who acts between you and the exchange.

After concluding an agreement, the broker gives access to the stock market. And you can perform purchase and sale transactions.

In our case, buy stocks that pay dividends.

The whole process is very similar to the procedure for interacting with a bank:

- You sign an agreement.

- Deposit money into your account.

- You get access to the exchange.

- You buy shares.

Do all companies pay dividends?

I won’t say everything right away. There are companies that do not pay dividends to their shareholders.

A reasonable question immediately arises: What are they for then? Where is the benefit?

A small educational program.

Investor profits can be generated in two directions:

- Receiving dividends.

- Increase in value over time of purchased shares.

The first point is clear. The company pays out a portion of its profits to its shareholders annually. Everyone is satisfied and happy.

But besides this, all companies invest profits in expanding their activities and business. Due to this, the value of the company (capitalization) begins to increase over time. Sometimes even several times. And since a share is a piece of a company, we are seeing an increase in quotes for it.

By paying money to shareholders in the form of dividends, the company allocates less funds to development. And theoretically, progress will be slower than for companies that plow all their profits back into the business.

There is an opinion that high dividends hinder development. Or the company's management cannot find a better use for the money other than paying its shareholders.

Can a company stop paying dividends?

Maybe. There can be many reasons: from a change in dividend policy, to a “bad” year, or the direction of free cash flow to other higher priority (according to management) goals.

There may also be a sharp decrease in the level of payments, literally by several times. In some cases this is temporary. And in the future, the company tries to reach the previous level or even exceed it, compensating shareholders for lost profits.

Sberbank dividends

Sberbank dividends Example. 2014 was a very difficult year for Sberbank financially. As a result, shareholders received only 3% of the company's profit or 45 kopecks per share (a year earlier it was 3.2 rubles). In 2017, based on the results of the previous (2016) period, the dividend payment increased 13 times!!!

How does a company know who needs to pay and how much?

All data on shareholders is stored in an electronic register. But the problem is that during one trading session tens of millions of shares are bought and sold. Tens, hundreds of thousands of shareholders change every day.

Therefore, a date is selected (known in advance to everyone) or the date of closing the register on which all shareholders will receive dividends.

It turns out that in order to be eligible to receive dividends, it is enough to be the owner of the shares for only one day.

What is the dividend cut-off?

This is precisely the closing date of the register. After the end of the trading session, investors who have company shares in their portfolio are entitled to dividends.

But there is one caveat.

As a rule, just before the dividend cutoff (several days in advance), quotes begin to rise. Everyone wants to participate in the profit sharing. There is significant demand for securities. And according to the law of the market, if demand exceeds supply, prices increase.

The day after the dividend cutoff, the value of the shares themselves drops sharply. Usually by the amount of promised dividends.

The company has already registered its holders and for many who are committed to short-term trading, the shares are no longer of interest.

And you can observe the dividend gap (gap on the chart). Here's what it looks like using Severstal as an example.

The company set shareholders a 3.97% dividend yield. The next day, quotes fell by almost the same amount - 4.05%.

What is dividend yield?

A certain amount of cash compensation is paid per share. This is a percentage of the share price at the dividend cutoff.

For example, dividend payments per 1 share are 7 rubles. The promotion costs 100 rubles. We get a dividend yield of 7%.

How much and how often are dividends paid on shares?

In most cases, each company makes payments once a year. Less than 2 times (Alrosa-Nyurba, Gazprom Neft, Moscow Exchange, NorNickel). There are companies that “pamper” their shareholders with payments once a quarter (MMK, NLMK, PhosAgro).

How many dividends does one share bring?

Traditionally, the telecommunications sector boasts higher dividends: MTS, Megafon and Rostelecom - about 7-10%.

Oil and gas, which includes Lukoil, Gazprom and Rosneft, provide 6-8% dividend yield.

The financial sector (Sberbank, VTB) is not very generous with payments - only 3-4%.

Utility service providers can pay either very good dividends (Rosseti, Unipro, RusHydro - 7-10%), or very meager dividends - 1-2%.

Dividend payment calendar

You can find out which shares pay dividends on the website of any broker (bcs-express.ru/dividednyj-kalendar), or on specialized resources (for example, dohod.ru/ik/analytics/dividend).

Pay attention to the last 2 columns. Using the example of Alrosa. To be eligible to receive rewards, you need to buy securities 2 days before the dividend cutoff. This is due to the trading mode on the exchange (T+2). When buying (or selling) shares on the stock exchange, a record of the new owner will be recorded only after 2 days.

How much money do you need to buy shares?

The price of shares on the stock exchange can vary from a few kopecks to tens of thousands of rubles. Typically, shares are sold (and bought) in lots.

A lot is the minimum number of company shares required to complete a purchase and sale transaction.

Thus, the huge spread in prices of different companies is averaged out. As a result, the minimum price of one lot is approximately 500 - 1,000 rubles.

- 1 Sberbank paper costs 220 rubles. The minimum lot is 10 shares. The total price of the lot is 2,200 rubles.

- 1 Magnit paper = 1 lot = 6,400 rubles.

- VTB is valued at only about 5 kopecks per share. But to buy it, you need to pay 500 rubles for a set of 10,000 shares.

Thus, even with only a few tens of thousands on hand, you can purchase several types of shares of different companies.

How will I receive dividends?

After closing the register, the company usually transfers the due remuneration to its shareholders within a month. The money goes to the brokerage account.

Do I need to pay tax on dividends?

Definitely yes! How are dividends taxed?

All profits received from dividend payments are classified as personal income (personal income tax) or income tax.

The standard tax rate is 13%.

Good news. The state exempted individuals from paying taxes on their own.

A broker is a tax agent. And he himself withholds the required taxes in favor of the budget.

At the time of payment of dividends, part (13%) of the amount received goes to pay taxes.

The investor receives the amount already cleared of taxes.

So, ordinary investors don't need to bother. They will do everything for you.

Is it possible not to pay taxes?

In some cases, you can completely or partially avoid taxation.

In case of loss.

The tax base is calculated based on the results of the year. That is, on all profits received by the investor (which includes the receipt of dividends and transactions for the purchase and sale of securities) you must pay 13%. If there were unsuccessful transactions that led to losses, and profits were made on dividends, then everything is added up and the net result is displayed.

And it is from this that the tax must be paid. And since the dividend payments have already been fully withheld, the tax base is recalculated at the end of the year. And the overpaid tax is returned back to your account.

Example. During the year, the investor received dividends totaling 100,000 rubles. The broker withheld 13% tax or 13 thousand.

At the end of the year, the investor also sold shares at a loss of 100,000 rubles, as a result of a collapse in quotes for previously purchased assets.

Total: net profit for the year is zero. And there is nothing to take tax from.

But since the broker previously withheld 13% from the dividends received, he is obliged to return this amount in full to the investor.

Tax benefits

When opening an individual investment account (IIA) of the second type, the investor receives a complete tax exemption in the amount of 1.2 million.

This is especially true for large players with assets worth several million in their portfolio. Then all the profit received remains in the account.

For small private investors, it is preferable to choose . It allows you to take advantage of a tax deduction of 13%.

Simply put, every year you can return 13% of the amount deposited for this period.

If you put 100 thousand into your account, you have the right to return 13,000 rubles, for 200 thousand - 26,000, for 400,000 - 52 thousand rubles.

52 thousand rubles is the maximum amount of tax deduction under IIS per year.

The company's net profit is subject to use in the following way: for investments for development and for dividends. The amount of amounts intended for division between the founders depends on the results of the company.

According to the company's policy, half of the net profit or another part of it can be used for such purposes. The remaining funds are used for the needs of the organization. Thus, the direct source is company profit.

Paid from “net” profit, this revenue is subject to accounting registration. Dividends will not be considered as such if they were paid during the year, but according to the results of the annual reporting the company was at a loss. And also they will not be included as expenses aimed at generating profit in tax accounting.

Consequently, an enterprise operating at a loss does not have a source for distributing them. Interim payments will be recorded as “Other expenses”.

Regulations and regulatory framework

The issuance of dividends to founders in an LLC is regulated by Law No. 14-FZ “On LLC” dated 02/08/1998. Article 28 states that it is mandatory to have a decision of the general meeting of participants, on the basis of which this distribution of funds is made.

The issuance of dividends to founders in an LLC is regulated by Law No. 14-FZ “On LLC” dated 02/08/1998. Article 28 states that it is mandatory to have a decision of the general meeting of participants, on the basis of which this distribution of funds is made.

The law assumes the following rules for LLC:

- The payment is calculated taking into account the founders' shares in the authorized capital. Since this is the only way to legally distribute funds, each LLC participant must take a responsible approach to the issue of participation of members of the enterprise in the capital even when registering the company.

- Only the founders have the right to receive payments. This is their main income from the operation of the enterprise. In addition, each participant has the right to occupy a position and receive a salary, which is a second source of income for him.

- Payment cannot be made more frequently than quarterly. The LLC also has the right to do this once every six months or year. More specifically, the issue of frequency is reflected in the charter. Interim dividends are those distributed before the end of the year. The company may be at a loss at the end of this period. In the absence of profit, the distribution of amounts cannot be considered dividends, although the funds have already been distributed. Then they can be recognized as a reward

For example, there is a decision of the meeting to pay funds once a year, which does not contradict the charter. Then dividends for 2019 can be calculated and accrued in 2019. The net income of the enterprise for this period will be determined.

For example, there is a decision of the meeting to pay funds once a year, which does not contradict the charter. Then dividends for 2019 can be calculated and accrued in 2019. The net income of the enterprise for this period will be determined.

After the decision on payment is made, funds are transferred to the participants within 60 days (more specifically, the period is described by the decision or charter). Although this can be not only money, but also products or property, which must be separately prescribed by the charter. If dividend payment deadlines are not met, the founders may demand the transfer of funds from the organization, and then through the court.

Since net profit is finally calculated only at the end of the year, at its end, it is most convenient to consider the issue of payment for this period. At the meeting of the LLC it is decided:

- what part of the profit will be allocated for this;

- how it is distributed;

- when will it be issued.

The regulations have not changed in 2019.

- Meeting dates- March, April. The decision will be made based on the number of votes.

- Necessarily drawing up a protocol indicating the meeting participants, agenda and resolution.

- Payments are made cashless to the bank account of each LLC member.

The decision to pay dividends is made by all owners of the LLC, that is, its participants.

The phased payment procedure consists of next steps.

For 2019, payment of dividends by LLC should be taxed at 0-13%, and personal income tax is 13%.

Payment nuances

Considering special cases and situations, you can specify the following nuances when calculating dividends (according to the rules for 2019).

If an organization has only one founder, he can accrue these payments to himself. The decision is made arbitrarily, but should include:

- the amount allocated for this payment by LLC;

- the period of time for which it is calculated;

- date of decision, place and protocol number;

- signature of the sole founder.

The rules for payments to legal entities are the same as for individuals, with the exception of taxation.

Decisions on payments may indicate deadlines (in 2019) that do not coincide with the maximum (2 months). There is no contradiction with the law in this.

Features of taxation

If the deadline for issuing funds to the founders is 60 days from the date of adoption of the decision at the meeting of the LLC, the tax is transferred to the budget no later than the next day after payment (Article 287 of the Tax Code of the Russian Federation).

Amounts of contributions for the Russian budget for 2019 following:

- Individuals receiving dividends pay personal income tax at the rate of 13%.

- Legal entities - from 0 to 13%.

- Foreign companies or citizens - 15% (both for income tax and personal income tax).

Let’s take a closer look at the terms of collection for LLCs in 2019. The percentage of state duty depends on several factors. A 0% rate can be received by a member of an LLC who has owned at least 50% of the authorized capital for more than a year.

Distribution

Usually distribution of payments depends on the share of the authorized capital of each founder. The formula could be as follows:

Dividends for an LLC member = amount allocated for their payment * percentage share of participation

But the company has the right make a different decision on distribution(disproportionate to shares). Then there is a possibility of disagreements with tax authorities.

According to Art. 43 of the Tax Code of the Russian Federation, only income calculated in proportion to participation in capital is considered dividends. Otherwise, parts may be considered as other income and taxed at a higher rate. Such an opinion of the inspectorate is usually supported by the court.

According to Art. 43 of the Tax Code of the Russian Federation, only income calculated in proportion to participation in capital is considered dividends. Otherwise, parts may be considered as other income and taxed at a higher rate. Such an opinion of the inspectorate is usually supported by the court.

For example, if the share of the founder of an LLC is 30%, he will receive 30% of the funds allocated by the company to pay dividends. Sometimes the charter contains a different issuance procedure that does not depend on the shares, or this is prescribed by the agreement on the establishment of the LLC, or by the decision on the distribution of income.

- period;

- amounts;

- proportions;

- founders to whom funds are paid;

- terms of issue;

- forms (monetary, property or other);

- other information.

Types of reporting

Dividends paid are included in reports:

- accounting;

- on payment of taxes.

If an LLC intends to issue dividends in 2019, it must, after completing this procedure, send it to the tax authority certificate 2-NDFL indicating the amount.

Reporting regarding tax deductions is directly dependent on the recipient of payments: an individual (founder) or an organization. There is no need to submit an income tax return in 2019, since this responsibility is assigned only to shareholders. This was reported by the Ministry of Finance of the Russian Federation back in 2015.

When paying dividends to foreign companies, you need to submit an information report on taxes to the Federal Tax Service: the amounts of payments and deductions for the budget of the Russian Federation. The deadlines are up to 28 days from the end of the reporting period for which payments were made.

An interesting transfer regarding dividends for an LLC is presented below.