The average repayment period of accounts payable is calculated as: Formula for calculating accounts payable turnover

The coefficient is equal to the ratio of the number of calendar days in a year to the turnover ratio of accounts payable. The initial data for the calculation is the balance sheet.

It is calculated in the FinEkAnalysis program in the Business Activity Analysis block as the Turnover period of accounts payable.

Duration of accounts payable turnover - what shows

Shows the average period for repayment of a company's debts (excluding obligations to banks and other loans)

Duration of accounts payable turnover - formula

General formula for calculating the coefficient:

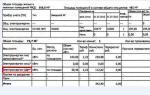

Calculation formula based on balance sheet data:

| K dox = | Period in days |

| To okz |

Where To okz- accounts payable turnover ratio.

Accounts payable turnover duration - value

The longer the repayment period, the higher the risk of non-repayment. This indicator should be considered by legal entities and individuals, types of products, payment terms, i.e. terms of transactions.

Acceptable values: the fewer days it takes to turn over accounts payable in terms of accounts payable, the better.

Duration of accounts payable turnover - diagram

Was the page helpful?

Synonyms

More found about the duration of accounts payable turnover

- Assessing the financial performance of mergers and acquisitions

The discrepancy in the duration of the accounts payable turnover is relatively small: 8 days; therefore, from the point of view of the financial cycle, it is more efficient - How to estimate the value of a company adjusted for the crisis

X 100% duration of accounts payable turnover average amount of accounts payable for the period X 365 days cost of goods sold - Financial analysis of an enterprise - part 2

The turnover period of accounts payable is determined as the quotient of dividing the duration of the analyzed period by the accounts payable turnover ratio - Business activity indicators of Elan-95 LLC

The accounts payable turnover ratio increased by 9.7 turns in 2015 compared to 2007, at the same time, the duration of the accounts payable turnover decreased by 58 days, which indicates competent and flexible credit - Errors in management analysis and recommendations for eliminating them

Average short-term accounts payable for the period Must be comparable to the duration of turnover For normally functioning organizations, the value - Methodology for analyzing current assets of a commercial organization

Tdz - turnover in days, average duration of one turnover of accounts receivable Tfc - duration of the financial cycle in days Tkz - turnover in days... PR 13 where Tkz - turnover in days, average duration of one turnover of accounts payable SPR - cost of goods sold, products, works, services Zsr - average balances of accounts payable - Analysis and management of accounts receivable during the financial crisis

Moreover, in a crisis, it is not so much the duration of the receivables turnover that is important, but that it does not turn out to be longer than the accounts payable turnover. When forming the conditions for commercial lending, it is worth understanding that even in - The role of business activity analysis in the organization's accounts payable management system

Accounts payable turnover ratio in turnover 16.17 18.09 9.93 -6.24 Duration of one turnover days 22 20 36 - Improving the methodology for analyzing the solvency and liquidity of organizations

OKZ reflects the period from the moment of occurrence of accounts payable until the moment of its repayment. The duration of turnover of OZ inventories characterizes the average shelf life - Financial analysis of an enterprise - part 4

Turnover period for the total amount of accounts payable days 360 1.5 240 360 1.3 277 37 Duration of the operating period - Financial cycle and return on assets of Russian food industry companies: empirical analysis of the relationship

They found that the duration of all components of working capital, including the turnover period of accounts payable, has an inverse relationship with profitability - Assessment of business activity of an enterprise based on asset turnover indicators

The only positive thing is that the turnover period in days of accounts receivable is less than the turnover period in days of accounts payable, that is, the funds will arrive earlier than they need to be paid. Thus, summing up - Peculiarities of interpretation of the results of analysis of the financial condition of agricultural organizations

The analysis process requires an in-depth factor analysis of the influence of the turnover rate on the dynamics of changes in the level of profitability of assets, as well as the rationing of inventories in the context of their types... The lack of real leverage over buyers and suppliers determines the minimal difference between the duration of the operating and financial cycles in agriculture. Due to this that the possibilities of conditionally free... Due to the fact that the possibilities of conditionally free financing by increasing accounts payable are objectively limited, the dynamic and structural analysis of its value takes on special importance, for which it is necessary to compare the rate of change in accounts receivable and sales In the case of interconnection and balance of rate indicators with high probability - Analysis of financial statements. Practical analysis based on accounting (financial) statements

Duration of inventory turnover days 365 x p 1 p 2 183 209 207 278 355 It is observed... An increase in the balance of finished products in the warehouses of the enterprise leads to a long-term freezing of working capital, a lack of cash, the need for loans and payment of interest on them... An increase in the balance of finished products in the warehouses of the enterprise leads to a long-term freezing of working capital, lack of cash, the need for loans and the payment of interest on them, an increase in accounts payable to suppliers, the budget to employees of the enterprise for wages, etc. Duration of resource availability - Balancing the solvency of an enterprise and the liquidity of its financial resources

The tendency towards growth in their composition of hard-to-sell assets, doubtful accounts receivable, inventories of inventory items with a long turnover period can make such an enterprise unable to meet its obligations; a slowdown in the turnover of current assets - Accounts receivable turnover ratio

D12 shows during what period the enterprise must be reimbursed for its funds in the form of the cost of products produced or services provided and inventories and accounts payable must be sold in the form of the cost of products produced or services provided. The longer the duration of the financial cycle - Duration of turnover of finished products

An increase in the balance of finished products in the warehouses of the enterprise leads to a long-term freezing of working capital, a lack of cash, the need for loans and the payment of interest on them - Organization's loan portfolio management

Most companies, when determining the duration of deferred payment on commercial loans, focus on competitors, but it is necessary to monitor the rate of receivables turnover - Capital turnover management

The duration of the financial cycle d12 shows during what period the enterprise must be reimbursed for its funds in the form of the cost of products produced or services provided and inventories and accounts payable must be sold in the form of the cost of products produced or services provided. The longer the duration of the financial cycle - Study of the influence of the duration of operating and financial cycles on the financial stability of enterprises in the Tula region

Calculation of the need for own working capital as the difference between the average amount of capital invested in current assets and the average balances of accounts payable ... NOK AZOT 2014 2013 2014 2013 1 Duration of storage of inventories days 22.47 25.49 20.11 24.94 2 Duration of the production process days 0.397

These are calculations for the following debt obligations:

- Amounts of debts incurred for services rendered and work performed, as well as materials used.

- Refunds for sold products.

- Budget payments, in particular personal income tax.

- Debts for everyone.

- Salaries and expenses.

- Payments to founders of dividends.

- Repayment of advances and settlements with creditors.

According to regulatory documents, turnover cannot be more than 40 days.

Determining the financial condition of the company

Turnover analysis is necessary to assess the financial position of the company. Competent verification using economic formulas is provided in reports for company directors, investors and creditors.

The calculation is carried out according to the main indicators, the main one of which is the accounts payable turnover ratio. The higher this indicator, the better the liquidity of the enterprise. Its value in turnover is shown by the following formula: Accounts payable turnover ratio (ACR) = cost of goods / average annual accounts payable (total debt at the beginning and end of the year, divided by two)

This value is higher the sooner the company is able to repay its debts. It clearly demonstrates how many times during the year the company was able to pay its debts to creditors. An increase in turnover indicates an increase in business activity.

With the right business management strategy, the cash balance can, when payments are deferred, first decrease slightly and then begin to grow. This parameter does not have normatively approved values. To use debt as a source of additional financing, it is beneficial for the company to maintain a low ratio at the initial stage.

Parameters for assessing company performance

Duration of accounts payable turnover

It is calculated as the ratio of the number of days in a year to the KKZ based on accounting data. The lower this parameter, the less time is required in the part that relates to account turnover. As a rule, the term is considered according to the terms of concluding transactions with individuals and legal entities.

Turnover period

The indicator shows the average debt turnover time and is calculated as follows: Accounts payable turnover period = duration of the period in days / accounts payable turnover ratio

This time indicator characterizes the average deferment time for payments that need to be made to pay suppliers and creditors. That is, it shows how many days it takes to convert lending into money.

Duration of turnover

Duration of turnover = (average annual accounts payable / amount spent per year on purchases) x 365 = number of days

This indicator serves to clearly show the average number of calendar days required to settle payments with entities that provide purchases to ensure the functioning of the enterprise.

Turnover is influenced by factors such as the type of activity of the company, the scale of production and the specifics of the industry, in which the above indicators are compared with similar indicators of leading enterprises.

A competent manager must organize the work of the company so that any debts incurred are repaid on time. Therefore, it is necessary to calculate economic indicators and conduct comparative analysis for effective work every year.

Accounts payable turnover (Accounts Payable Turnover Ratio) is an indicator of the speed at which an enterprise pays its own debts to suppliers and contractors. shows how many times (usually per year) the company has repaid the average amount of its accounts payable.

In theory, the accounts payable turnover ratio is calculated as the ratio of the cost of acquired resources to the average amount of accounts payable for the period, using the following formula:

Okz = / (KZnp + KZkp) x 0.5

Where, Okz is the accounts payable turnover ratio; C - cost of sales; Zkp, Znp - inventories at the end and beginning of the period; KZnp, KZkp - accounts payable at the beginning and end of the period.

In practice, a common option for calculating the turnover ratio using the revenue indicator is:

Okz = V / [(KZnp + KZkp) / 2]

where, B is revenue.

Formulas for calculating the accounts payable turnover ratio on the balance sheet:

Okz = s(line 2120 + (line 1210kp - line 1210np)) / (line 1520np + line 1520kp) x 0.5

Okz = line 2110 / (line 1520np + line 1520kp) x 0.5

Regulatory documents provide the maximum value of the accounts payable turnover ratio: no more than 40 calendar days(Decree of the Government of the Russian Federation dated 04.05.2012 No. 442, Order of the Ministry of Economic Development of Russia No. 373/pr, Ministry of Construction of Russia No. 428 of 07.07.2014).

The turnover period (repayment) of accounts payable (POkz) characterizes the average turnover period of accounts payable and is calculated using the formula:

POkz = Tper / Okz

POkz =[(KZnp + KZkp) / 2] / V * Tper

where, Tper is the duration of the period in days (month, quarter or year in days).

The turnover period of accounts payable characterizes the average duration of deferred payments provided to the company by suppliers. The larger it is, the more actively the enterprise finances current production activities at the expense of direct participants in the production process (through the use of deferred payment of bills, regulatory deferment of taxes, etc.). This indicator allows you to judge how many months on average it takes a company to pay off creditors.

It is worth keeping in mind that a high share of accounts payable reduces the financial stability and solvency of the organization, however, accounts payable, if they are debts to suppliers and contractors, gives the company the opportunity to use “free” money for the duration of its existence.

Since accounts payable, in addition to obligations to suppliers and customers (for material assets supplied, work performed and services rendered), include obligations for advances received, to employees for wages, to social funds, to the budget for all types of payments, some distortions are possible What interests us most is the turnover of invoices payable to suppliers.

Additionally, for a more complete assessment of accounts payable turnover, it is recommended to calculate the indicator - Share of overdue accounts payable in the total amount of accounts payable (Dkz):

Dkz = Expired KZkp / KZkp * 100%

Where, Overdue KZKP - debt for which the payment deadline specified in contracts or in regulations has passed

The analysis of accounts payable, in turn, must be supplemented with an analysis of accounts receivable, and if the accounts receivable turnover is higher (i.e., the ratio is lower) than the accounts payable turnover, then this is a positive factor. In general, managing the movement of accounts payable is the establishment of such contractual relationships with suppliers that make the terms and amounts of payments to the latter dependent on the receipt of funds from customers.

Accounts payable turnover is an indicator of how quickly an enterprise repays its debts. This is an important parameter that allows you to track the company’s performance and outline a strategy for its management.

The accounts payable turnover ratio shows the volume of repayment of obligations to partners within the reporting period. The reporting period can be a year, a month, or a quarter. The value allows you to calculate the speed of payment of obligations to creditors. A high ratio indicates a high rate of debt repayment.

Formulas for calculating accounts payable turnover

In order to identify accounts payable turnover, you will need to calculate the ratio of the cost of purchased resources to the average volume of accounts payable for the period under review. Most often, it is not general obligations that are considered, but only those related to operational work.

This calculation allows you to display the liquidity and solvency of the organization, as it relates to credit risks. That is, high indicators reflect good liquidity and a sufficient level of solvency.

Calculation for the period

The following formula is used:

The following formula is used:

Turnover = purchases/average volumes of liabilities for the period

The formula is not suitable for accounting documentation, since it does not display the amount of purchased resources. Therefore, a simplified calculation is used:

Purchases = cost of sales + (inventory remaining at the end of a given period - inventory at the beginning of a given period)

However, this formula is rarely used in practice. Most often, the calculation includes revenue for the period. It is a replacement for purchases. When performing calculations, it is important to take into account the impact of VAT. If the volume of purchases does not imply the inclusion of VAT, then the results are also obtained without this value.

Calculation in days

Turnover can be calculated in days. You can do this as follows:

Required indicator in days = 365/accounts payable turnover ratio

This calculation shows the average period during which obligations to creditors are not paid. That is, it displays the duration of a revolution.

Analysis of the results obtained

A high ratio indicates a high rate of repayment of obligations. It indicates good liquidity of the company. For this reason, this calculation is carried out by the lenders themselves in order to identify preferred partners. However, it is also useful for the enterprise itself.

A high ratio indicates a high rate of repayment of obligations. It indicates good liquidity of the company. For this reason, this calculation is carried out by the lenders themselves in order to identify preferred partners. However, it is also useful for the enterprise itself.

Is a high turnover rate always good and is it worth striving for? An overvalued value indicates not only excellent liquidity, but also low profitability. That is, the organization has problems with profitability.

When identifying a value, it is important to correlate it with the period under consideration. Without the ratio, the full picture of the enterprise's efficiency will not be clear. High profitability is indicated by a receivables ratio that is less than a similar value. That is, the company has funds that can be freely disposed of, which contributes to its development.

For whom is it needed and what does the coefficient show?

The value considered is mainly data for finding ways to increase liquidity. It is important in the work of the following individuals and groups:

- CEO;

- Financial Manager and Director;

- Legal departments;

- Creditors of the company;

- Investors of the enterprise.

The indicator is one of the methods for assessing a company, important for both its managers and partners.

We calculate indicators of overdue receivables

This calculation is also important for managing an organization. The following formula is used for it:

This calculation is also important for managing an organization. The following formula is used for it:

KPDZ = Volume of “delays” for the period/total amount of creditors’ debts

The volume of “delays” can be found out from the debtor’s debt report. The total amount appears on the balance sheet. Ideally, you need to make calculations not for one period, but for several, and increase the duration taken for control. This will reveal the dynamics of change.

If the ratio of overdue accounts receivable increases, this means an increase in the share of “overdue” accounts. This indicates a slowdown in turnover and a decrease in the solvency of the enterprise.

All indicators give relative results.

There are no normal indicators for the selected duration of time. They are all very relative. To determine the norm, you need to find out the required value for the entire industry in which the enterprise operates. You can look at the odds of the growth leader. This will help to create an objective picture of the situation and assess the competitiveness of the organization.